According to the United States Treasury’s Financial Literacy and Education Commission, financial literacy is “the ability to use knowledge and skills to manage financial resources effectively for a lifetime of financial wellbeing.” They also suggest that there are five key components of financial literacy: earn, spend, save and invest, borrow, and protect. These lessons can be taught in simple ways, your kids will understand.

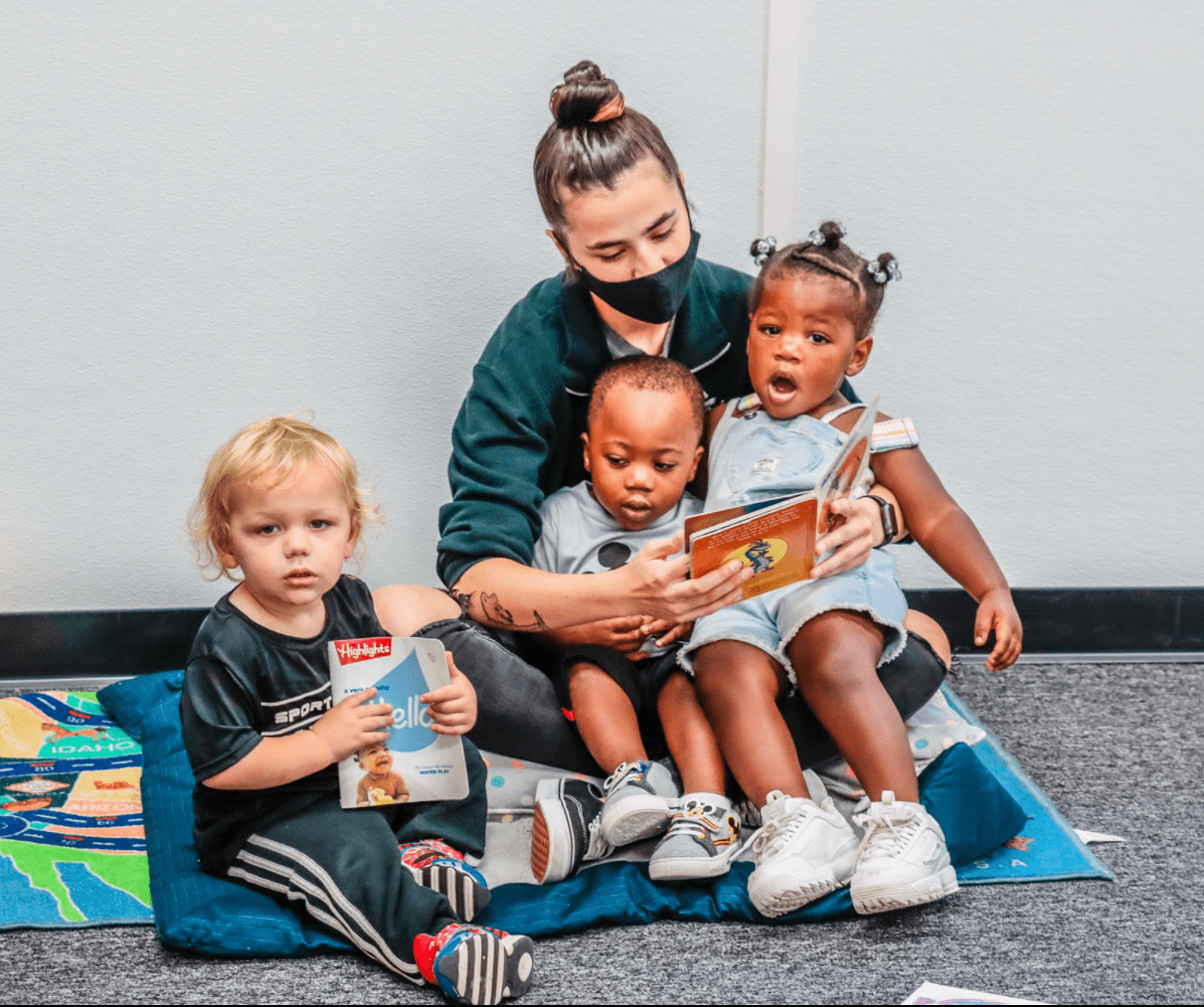

With National Teach Children to Save Day is coming up on April 27th, we wanted to share a few tips to help your child with financial literacy. Financial skills will benefit your children for the rest of their lives, and we believe it is never too early to learn some fundamentals!

Take Your Kids Shopping

Well, take them to the grocery store that is. Start with a set amount let them keep a running total of what you purchase. Will you have enough? Using cash can help children to better understand the concept.

Send Them to Jail

In Monopoly that is. Playing games that involve money is a fun way to introduce financial concepts. Budgeting, earning, saving, and spending are all great financial themes that can be taught using games. Get the whole family involved to make it a fun bonding time too!

Set Goals

When teaching kids about saving money, it’s important to set some goals. You can have them save, with the goal of making a purchase. Or you can have them aim for certain dollar amounts. Celebrate when you hit these milestones and congratulate your child on a job well done.

Have Them Earn Their Money

In order to reach their goals, your children will have to earn their money. You can do this in a variety of ways, so choose a method that makes sense for your family. Children can earn money from weekly chores, from special jobs, or by saving money when it is gifted to them. Ideally, a combination of all 3! Incorporating a chore chart, a sticker chart, or a visual representation of their savings is a good way to keep them motivated.

Let Them in on Your Finances

Don’t be afraid to let your children know what things cost. While you don’t need to divulge your yearly income to be shared on the playground, you can share what you are comfortable with. Taking a trip to Disney? Let them know what you are spending and how you are paying. Putting it out there can help them learn the value of things and to appreciate them more.

It’s never too soon to begin teaching your children financial literacy. Knowing how to earn, save, spend, and invest, will help them to be financially responsible adults. Let us know in the comments what you are doing to help your child gain financial literacy!